How to Determine Which Depreciation Method to Use

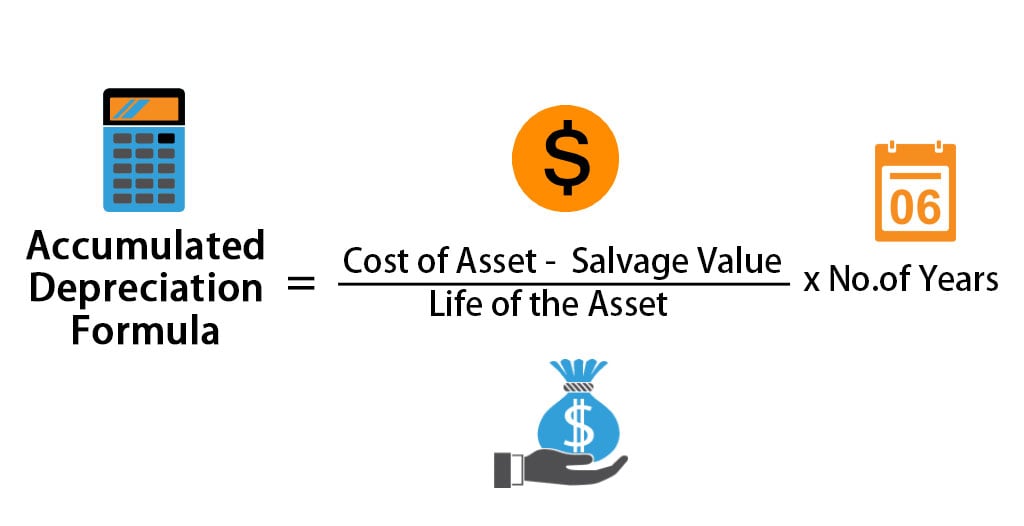

Depreciation expenses 150000 1000020000 2000 14000. In accounting terms depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible.

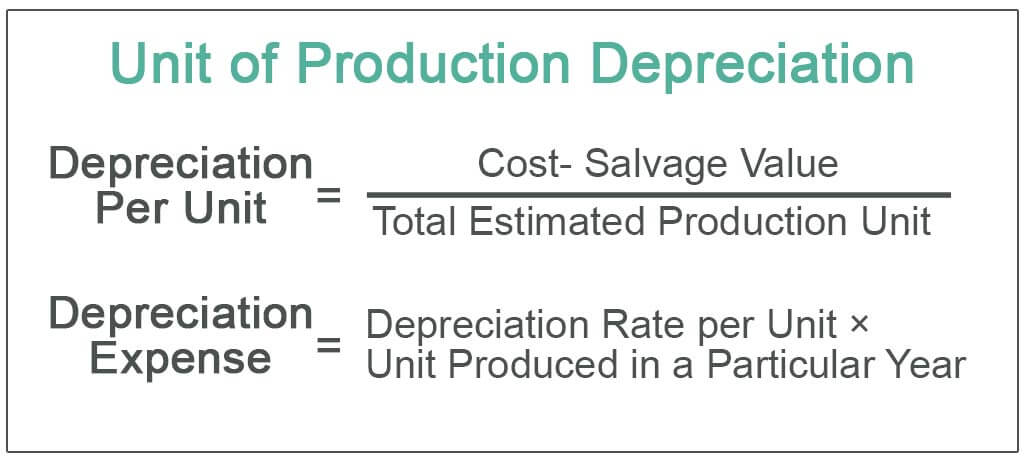

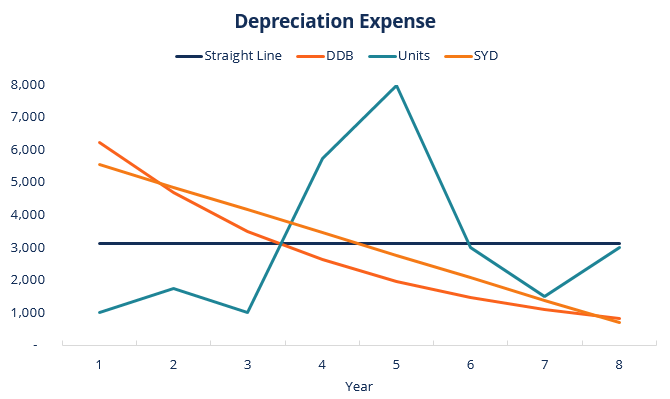

Unit Of Production Depreciation Method Formula Examples

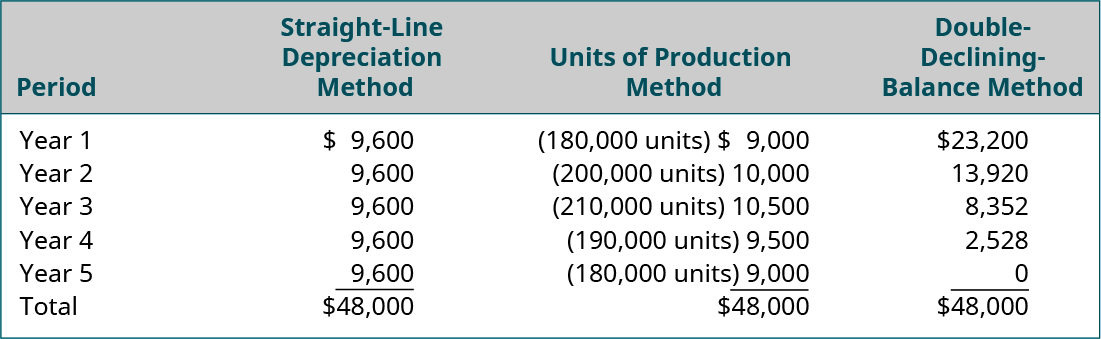

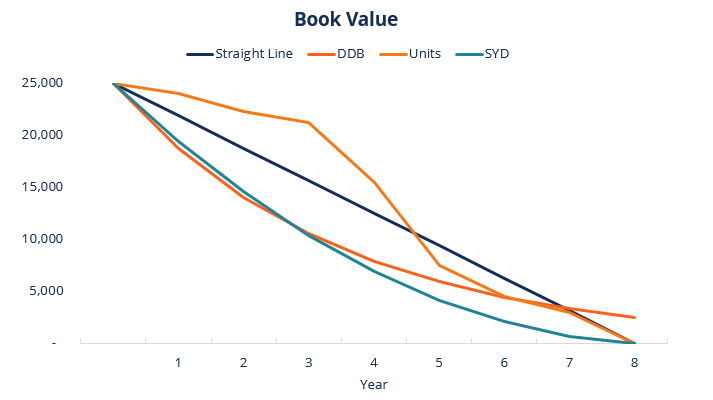

Under this method the business can track their profit and loss more accurately as compared to the straight-line method Straight-line Method Straight Line Depreciation Method is one of the most popular methods of depreciation where the asset uniformly depreciates over its useful life and the cost of the asset is evenly spread over its useful and functional life.

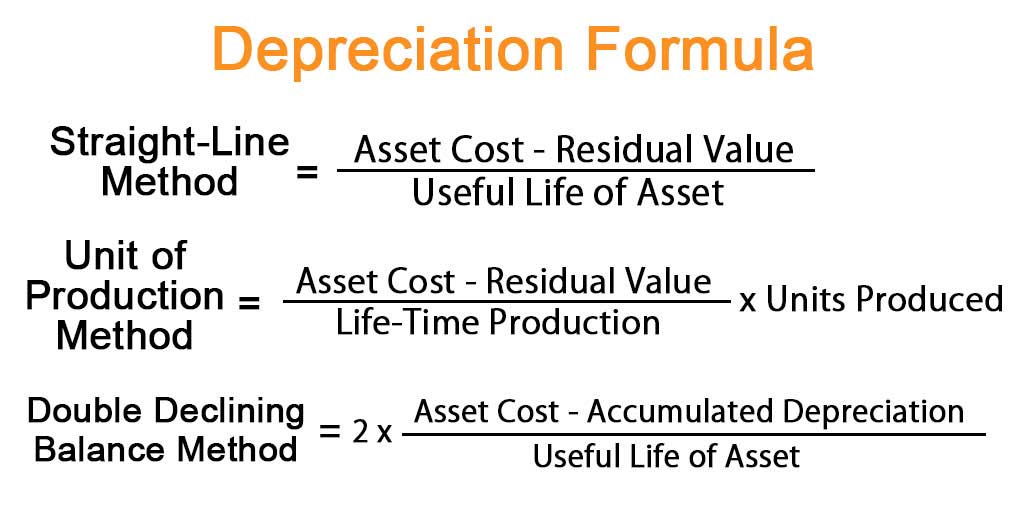

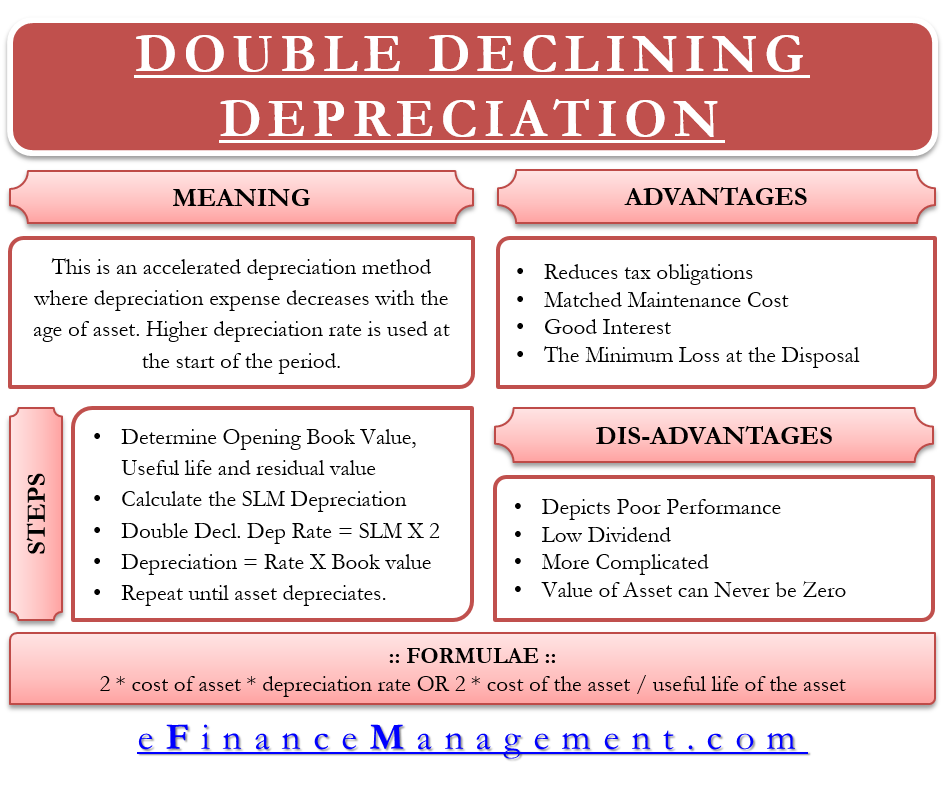

. Perhaps the most intuitive and straightforward method is the straight-line depreciation method. If you had been using the 150 percent double declining depreciation method you would have taken 15 x 1000 percent. By using the formula for the straight-line method the annual depreciation is calculated as.

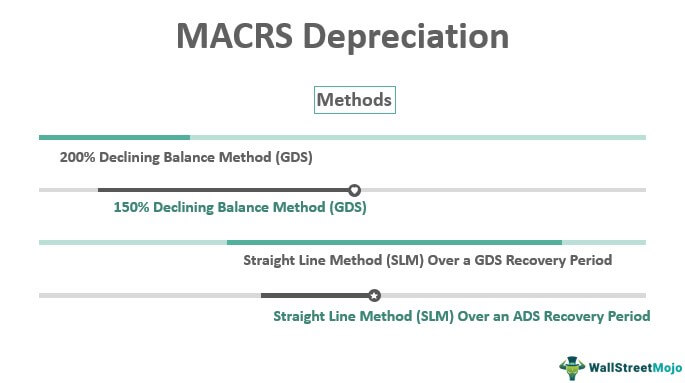

27 years This tax depreciation method uses the straight-line formula under the GDS that calculates an even depreciation amount over the. Determine the useful life of the asset. Depreciation Depreciation Rate x Cost of the Asset in a given year Example 3.

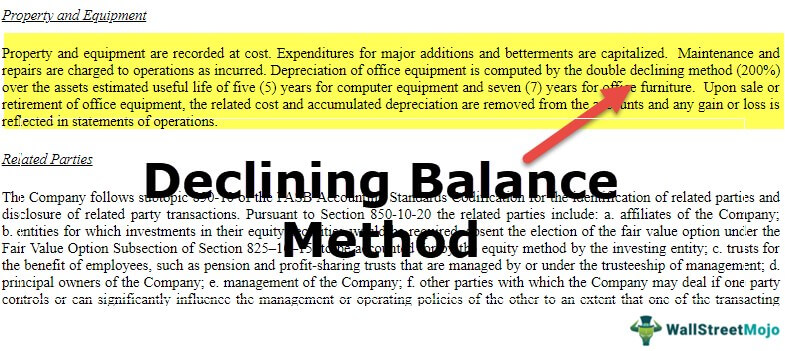

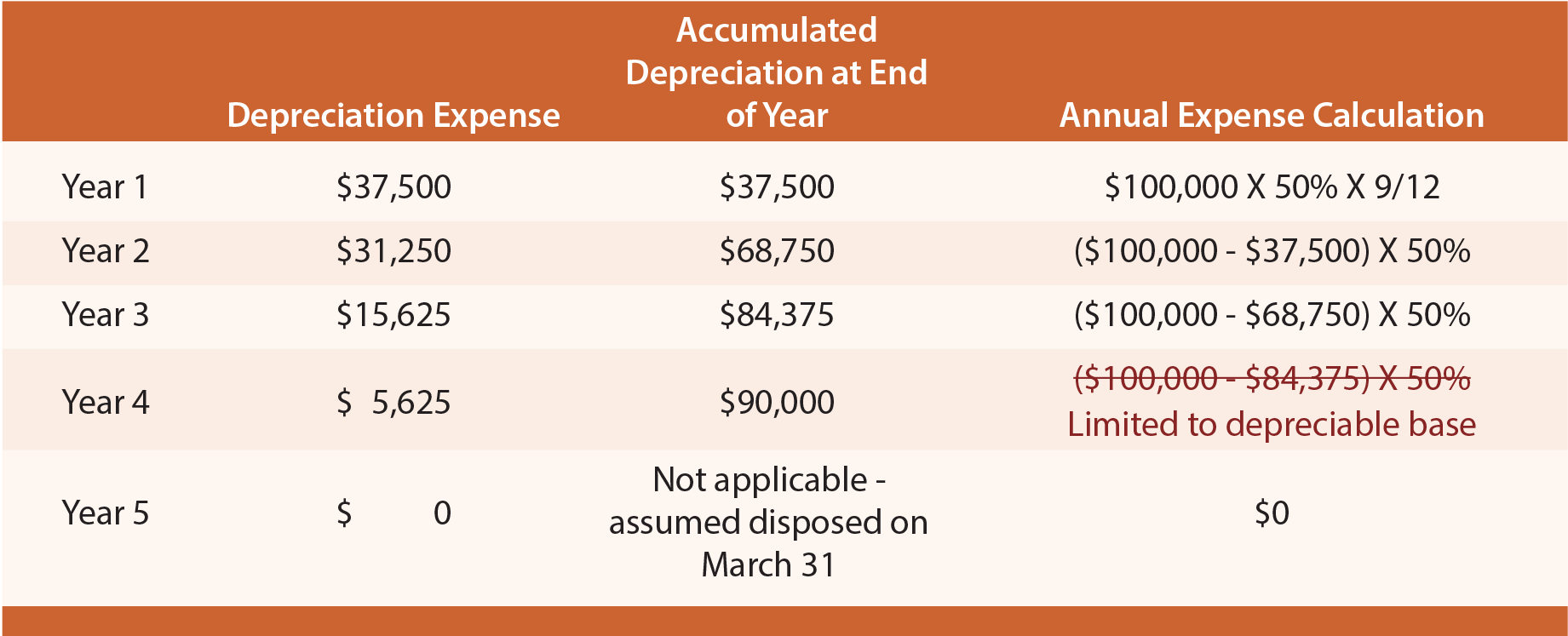

Calculating this amount involves determining the useful life of the asset the number of years before its value equals the scrap value and the difference between the original cost of the asset and its scrap value. There are several methods for calculating depreciation and in some circumstances the Internal Revenue Service IRS or other outside groups may require businesses to use a specific one. Now for the 200 percent method multiply 2 x 1000 percent to get to 2000 percent.

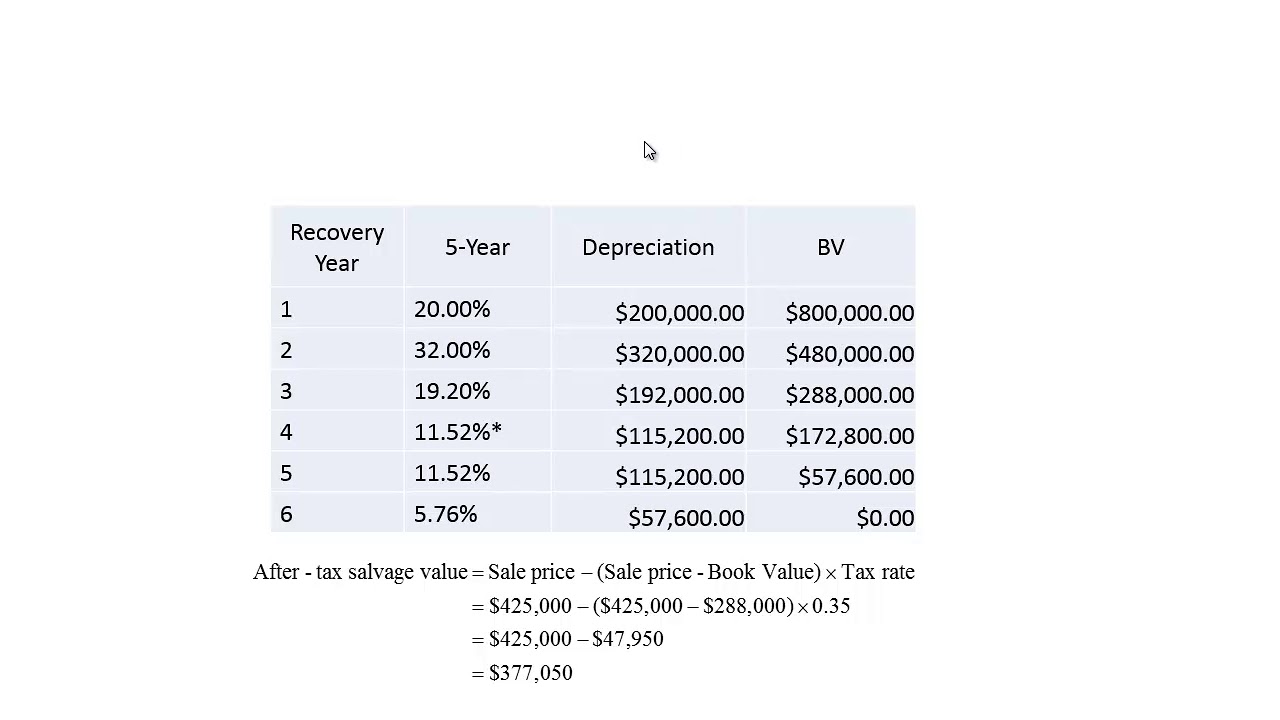

The following formula is used to calculate depreciation using Reducing Balance Method. To determine the depreciation rate table to use for each asset refer to the MACRS Percentage Table Guide. 369000 property cost basis 275 years 1341818 annual depreciation expense.

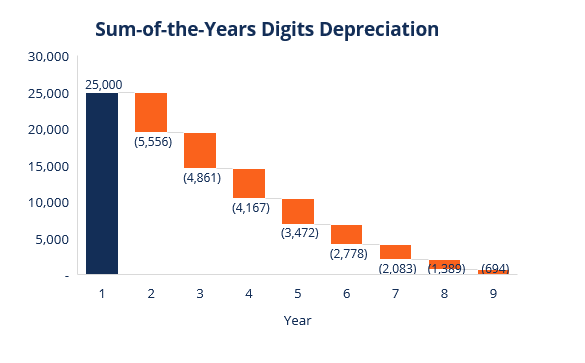

You should choose depreciation methods depending on how you choose to use the asset. This means the van depreciates at a rate of 5000 per year for the. Depreciation Original cost Residual Value x fracNo.

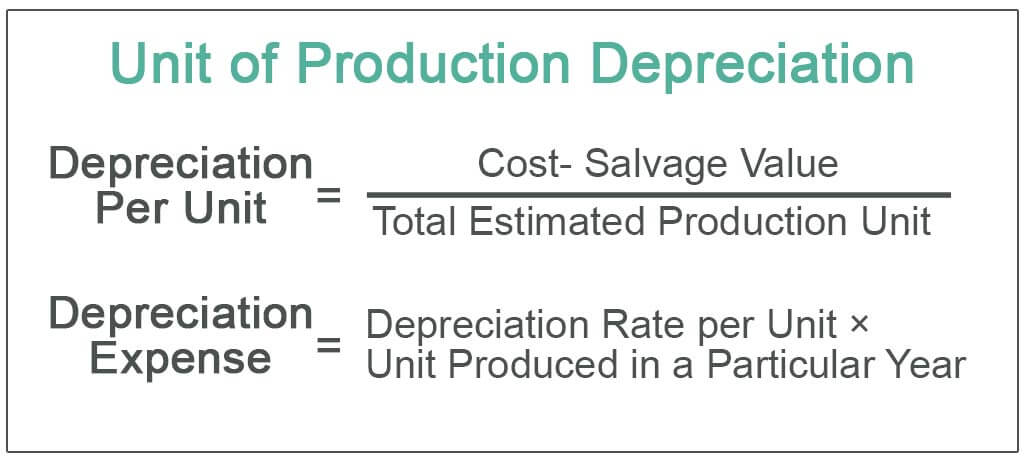

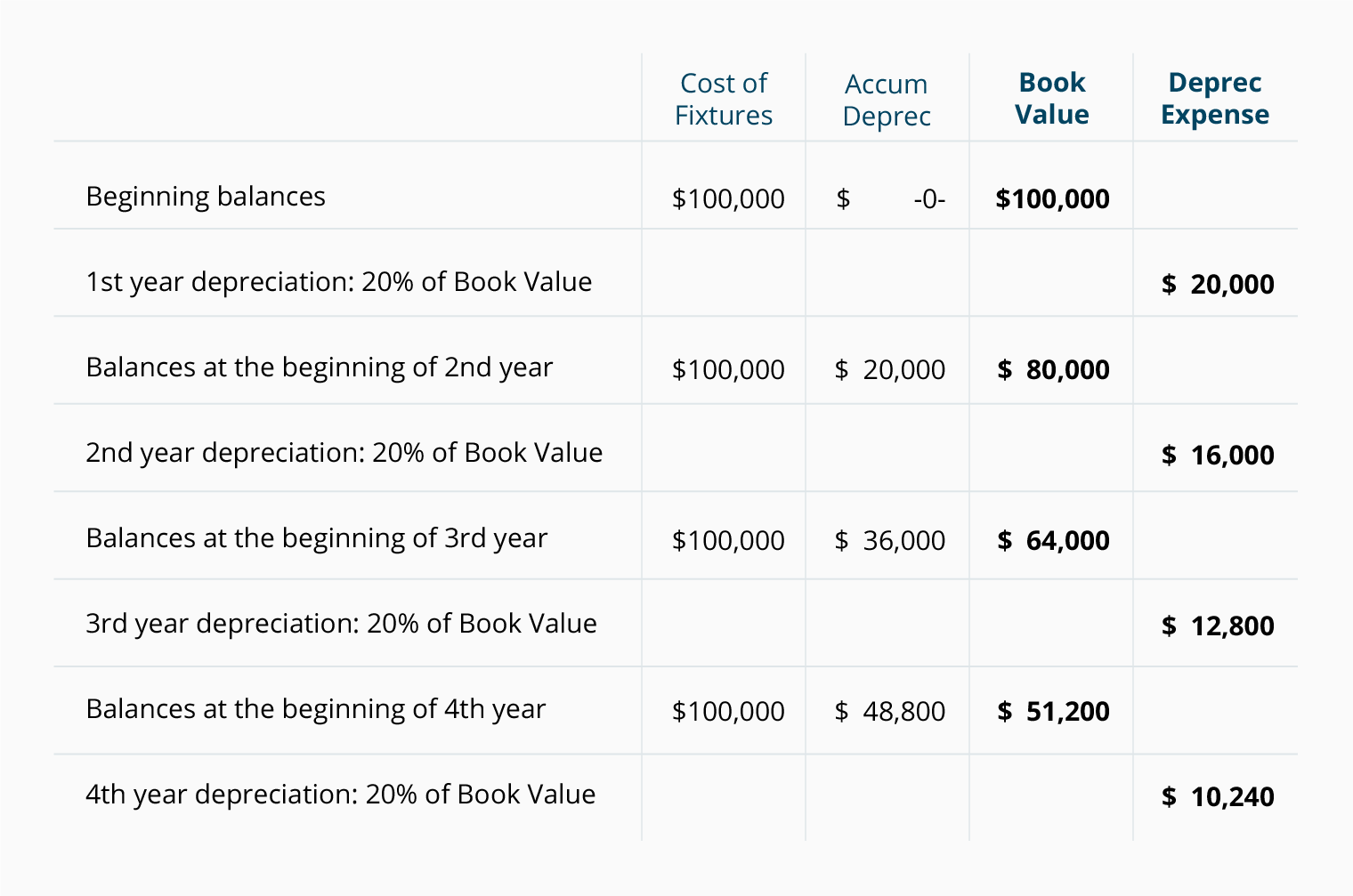

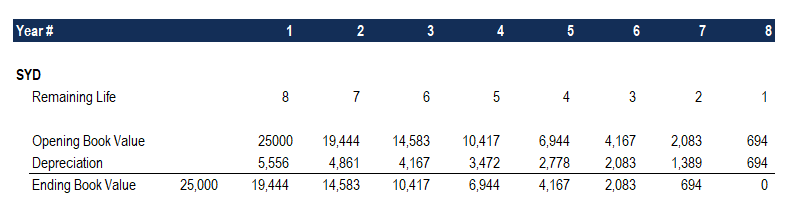

It is a variant of the diminishing balance method. Of years of the remaining life of the asset including the current yearSum of the years digits of life of the asset Sum of years Digits. Although the depreciation rate under the double-declining depreciation is two times the depreciation rate under the straight-line method the amount of depreciation expense charged under the straight-line basis is not its exact half.

In this method the depreciation is charged more in the early years of the asset and the depreciation amount. The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life. Subtract the assets salvage value from its cost to determine the amount that can be depreciated.

What is depreciation explain with an example. The formula for calculating the rate of depreciation is. Annual Depreciation 2 100 Useful Life in Years.

The straight line calculation steps are. Divide this amount by the number of years in the assets useful lifespan. In this method the asset depreciates by the same amount each year.

35000 - 10000 5 5000. Service life years. Use the following steps to calculate monthly straight-line depreciation.

The 150 reducing balance method divides 150 percent by the service life years. Calculation of the yearly depreciation amount. GDS using 150 DB.

Calculating depreciation can be straightforward or more complicated depending on the method employed. All 3 assets are considered to be nonfarm 5 and 7 year properties so we will use the GDS using 200 DB method. The company treasurer must determine the best depreciation method for office furniture that cost 50000 and has a zero salvage value at the end of a 10 years depreciable life.

The company will record a depreciation expenses of 14000 for the year 2018. The most commonly used method is the straight-line method it is the simplest method to use. Taking depreciation expenses each year is a way to reduce your business tax bill.

The original price of the machinery is 5000 the estimated useful life is 10 years the estimated residual value is 500 and the depreciation is calculated according to the straight-line method. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. 15-year and 20-year classes use 150 Declining Balance method GDS This depreciation method gives you a higher depreciation rate 150 more than the straight-line method.

Moreover how do you calculate 200 declining balance depreciation. All 3 assets will use Table A-1. As for the residence itself the IRS requires you to calculate depreciation over its 275 useful years using a different method called the modified accelerated cost recovery system.

To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. If your asset is a machinery or plant that works best during the initial years of its useful life and loses its capacity over time then you should use the reducing balance method. Determine the cost of the asset.

Remaining lifespanSYD x asset cost - salvage value. The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life. What You Must Know to Calculate Depreciation.

Depreciation is handled differently for accounting and tax purposes but the basic calculation is the same. Divide the sum of step 2 by. To determine the depreciation method to use refer to the Depreciation Methods table.

Divide by 12 to tell you the monthly depreciation for the asset. Calculate depreciation expense for the year 2018 using activity method of depreciation. Next apply a 20 percent depreciation rate to the carrying value of the asset at the.

Net Book Value Purchase Cost of the Asset Depreciation. Calculating Depreciation Using the Sum-of-the-Years Digits Method Formula. That percentage will be multiplied by the net book value of the asset to determine the depreciation amount for the year.

New computers were bought for USD50000 and are expected to last ten years when they will be replaced. Calculate Rental Property Depreciation Expense.

Depreciation Methods 4 Types Of Depreciation You Must Know

Double Declining Balance Depreciation Calculator

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Accumulated Depreciation Definition Formula Calculation

Straight Line Depreciation Method Online Accounting

Explain And Apply Depreciation Methods To Allocate Capitalized Costs Principles Of Accounting Volume 1 Financial Accounting

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Methods 4 Types Of Depreciation You Must Know

Straight Line Depreciation Formula Guide To Calculate Depreciation

Macrs Depreciation Definition Calculation Top 4 Methods

Double Declining Depreciation Efinancemanagement

Declining Balance Method Of Depreciation Examples

How To Use The Excel Db Function Exceljet

Comments

Post a Comment